Maintenance for Military Divorces

With all of the extra allowances that make up a big portion of a military member’s pay, determining the correct spousal maintenance amount in military divorce cases requires a clear understanding of the military pay system. In Colorado, all items on an LES (including base pay, the Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH)) are considered income when determining spousal maintenance obligations.

VA disability payments are also included as income for the purpose of determining the obligation. Disability payments may not be divided as a marital asset, but since they are intended to provide support for both the military member and their family, the VA payments may be defined as income for a child and spousal maintenance purposes.

Once finalized, a military member’s BAS and BAH are likely to reduce since their spouse and children are no longer considered dependents. If the decrease is significant, the military member may ask that their child and spousal maintenance obligations be re-evaluated to coincide with their new decreased income.

An Obligation for the Military

If a divorced service member fails to pay spousal maintenance, there are certain procedures in effect to ensure that the former spouse receives the proper support. In Colorado, the court has the power to order payments be subtracted from a service member’s paycheck so that the former spouse receives a check directly.

In addition, all branches of the military have regulations requiring their members to support family members after separation in the absence of an official court order to do so. However, this is a temporary fix and does not replace a formal court order mandating child or spousal maintenance payments.

A former spouse may seek assistance from the service member’s commander, the local JAG (Judge Advocate General) office, or the inspector general if the service member fails to meet their obligation.

Parenting Plan Considerations

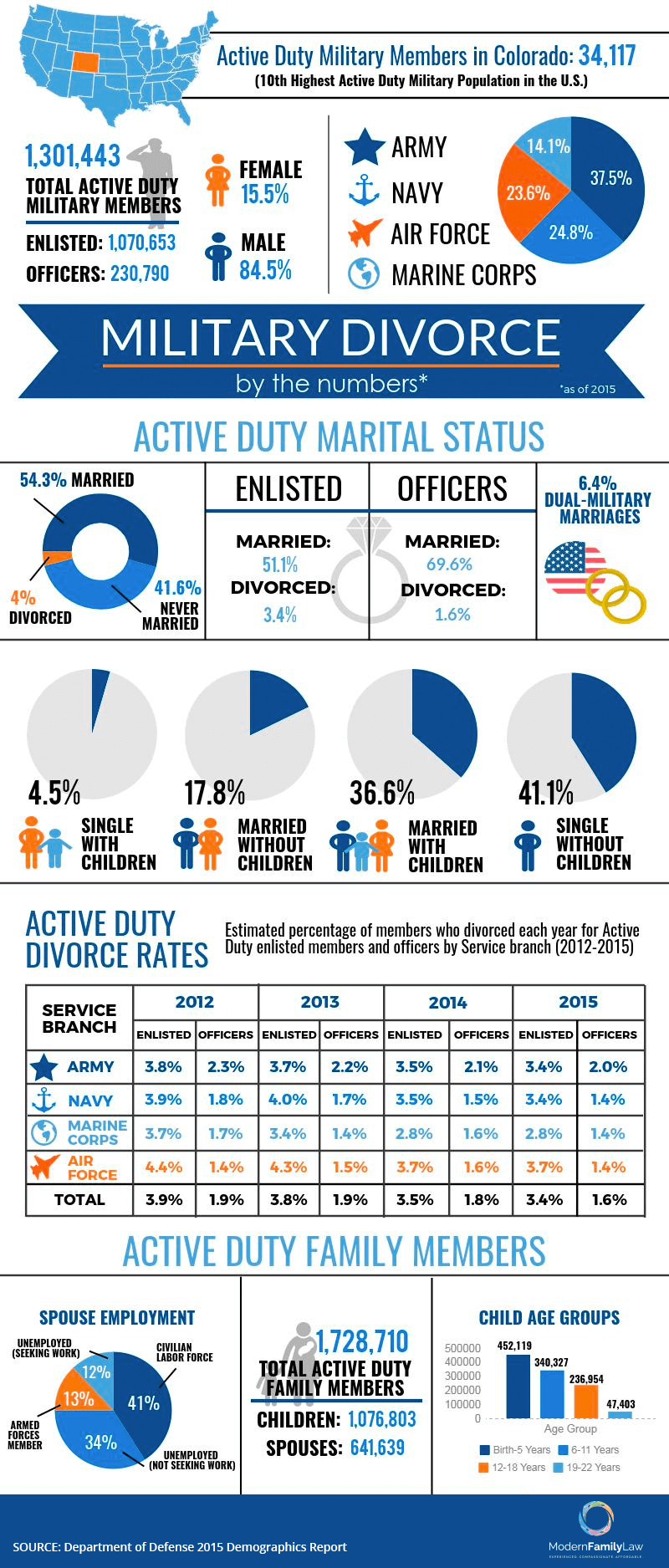

Colorado does not favor either the mother or a father more in determining who will receive the primary parental custody after a divorce. However, a civilian mother is often the person who takes on the primary caregiver role in military families, since almost 85 percent of armed service members are male.

With military members working long hours and frequently traveling for TDY’s (temporary duty) and deployments, they typically face many obstacles when it comes to taking on full parental responsibilities. However, the court is still obligated to examine each parent’s ability and willingness to provide care for the child and take the best interest of the child into consideration. This means that a military member can be deemed the primary parent when they provide the best care for the child. The military member needs a clear plan for the care of the child in the context of a busy military lifestyle.

If it’s deemed the civilian spouse the primary parent, they typically have parenting time and decision-making responsibilities for the majority of the year. For the service member in this situation, their parenting time would most likely be allocated during summer and other school breaks.

A common post-decree custody issue that occurs is when a service member may be deploying. The service member needs to consider who they would like to provide care for their children if deployed, and the non-servicemember spouse needs to similarly consider who will care for the children should the other parent deploy. Non-military families do not need to consider these areas. But where one party is active duty military or has the potential of deploying, it’s critical.

Dual Military Divorces

When two active duty military members with children make the decision to divorce, allocating parental responsibility becomes slightly more difficult. In a contested case, the court will have to determine which military parent can best serve the interests of the child. If both parties wish to be the primary parent, the court may appoint a CFI or PRE to evaluate the situation and recommend a solution for a parenting plan.

Both parents may also come to an agreement in which they both play an active parenting role in the child’s life. If this happens, both parents can work together to handle deployments and other factors of military life that may prohibit one parent or another from taking on full parenting responsibilities at certain times.

Impact on Benefit Plans

The Survivor’s Benefit Plan (SBP) is a retirement pay program available to retired military members that allows them to provide support for their spouse and children should they pass away. Upon the service member’s death, the military will deduct a partial amount of their retirement check every month and distribute it to their surviving spouse and children. A spouse will receive 55 percent of the retirement check until he/she reaches the age of 62. At that age, it reduces to 35 percent due to eligibility for Social Security payments.

In divorce cases, a divorced spouse is eligible for coverage by the SBP as a potential beneficiary. This can quickly become a highly contested issue. This is because payments for SBP payments deduct the majority of a retired service member’s disability check.

It’s important to keep in mind there is a one-year statute of limitations for filing the proper paperwork with the military after an award of SBP coverage. If the paperwork is not timely, the military refunds SBP payments and deducts it from the service member’s paycheck. The refund goes back to his/her estate and pays the former spouse nothing.

Navigating the Process

Going through a divorce is tough, especially with all of the stresses of military life. Fortunately for military members and their spouses, free legal advice and assistance are available via each installation’s legal assistance office. These offices are there to help, but can only provide legal guidance for one spouse or the other. They can not help both, due to a conflict of interest.

JAG officers are also available as a resource for military members and their spouses considering divorce. They can help spell out the legal implications of your divorce case. However, they cannot represent you as an attorney in a family law court. They can, however, refer you to a civilian family law attorney, such as Modern Family Law.

The Colorado family law attorneys at Modern Family Law are knowledgeable in military divorces. We are ready to help. Don’t hesitate to contact us today for a free consultation to discuss your case with one of our divorce attorneys in Denver or Colorado Springs.