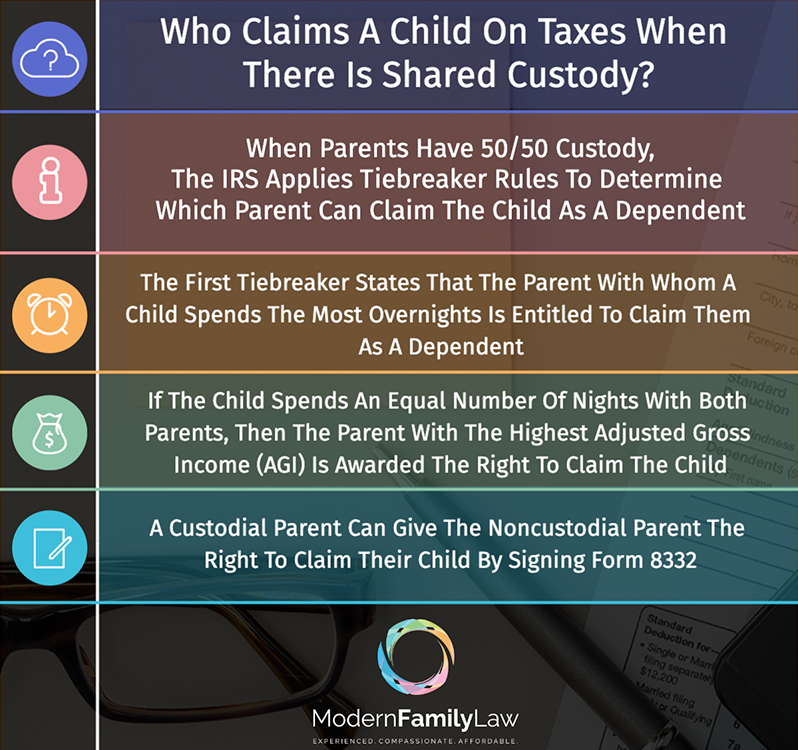

When parents separate or divorce, one of the most contentious issues is often the custody of their children. Apart from determining which parent will have physical custody of the child, a crucial question arises: who gets to claim the child as a dependent on their tax return? The Internal Revenue Service (IRS) has established tiebreaker rules for such situations, which are intended to provide guidance in determining who has the right to claim the child as a dependent. These rules can be particularly helpful when parents have shared custody of their children. In this article, we will explore the IRS tiebreaker rules for claiming dependents in shared custody situations.